There has been much talk lately about artificial intelligence being in a bubble on par with the dot-com bubble of the late 1990s. Skeptics will point to Nvidia’s 62 per cent sales rise last month as evidence that no such bubble exists, and Nvidia’s shares rose 6.5 per cent in after-hours trading on Wednesday.

But where did Nvidia’s sales come from? One of the things we know about the bubble—and I do believe AI is a bubble—is the existence of circular financing. That is where customers and vendors finance each other. Basically, investors, vendors, and customers are all intertwined, boosting each other’s stock price and bottom lines.

Consider the case of Nvidia. There is a kind of land rush to build out massive data centers to power AI. Those data centers need hardware with powerful GPUs. Enter Nvidia, which is the king of AI GPUs. (Fun fact: GPU stands for “Graphics Processing Unit”, a chip that offloads graphics processing from the main CPU. They originally appeared in gaming PCs. It was only until recently that they were used for AI computational loads.)

The new data centers are being built to accommodate future demand for AI services. But that is something that right now is a long way away. In a sense, this has echoes of the telecom bubble of the late 1990s that dovetailed with the dot-com bubble. Those were the days of WorldCom, Metromedia, and Qwest Communications who were all building fiber optic networks like there was no tomorrow. The problem was that the networks were far ahead of their time. Billions of dollars of capital was spent on fiber that stayed dark for years, until high-speed home internet and 4G cellular service arrived. The result was the bankruptcy of these companies, who went down with the dot-coms.

Being early in an investment is just as bad, if not worse, than being late.

AI is following the same pattern as the dot-coms and telecom bubbles.

- Media hype? ✅

- Insane valuations of stocks? ✅

- No idea when the companies will turn a profit? ✅

- Retail investors pouring money into the stocks? ✅

Except today it is worse in that professional investors—hedge funds and mutual funds, for instance—are getting in on the act, perhaps in a crazy bit of FOMO. When the dot-com bubble burst, it was mostly retail investors who got burned. Now it will be the retail investors along with the people who manage the money in your 401(k).

Michael Burry, the Big Short man who has predicted twenty of the last two recessions, has a short position on AI stocks, and if you look at the charts below you will see why.

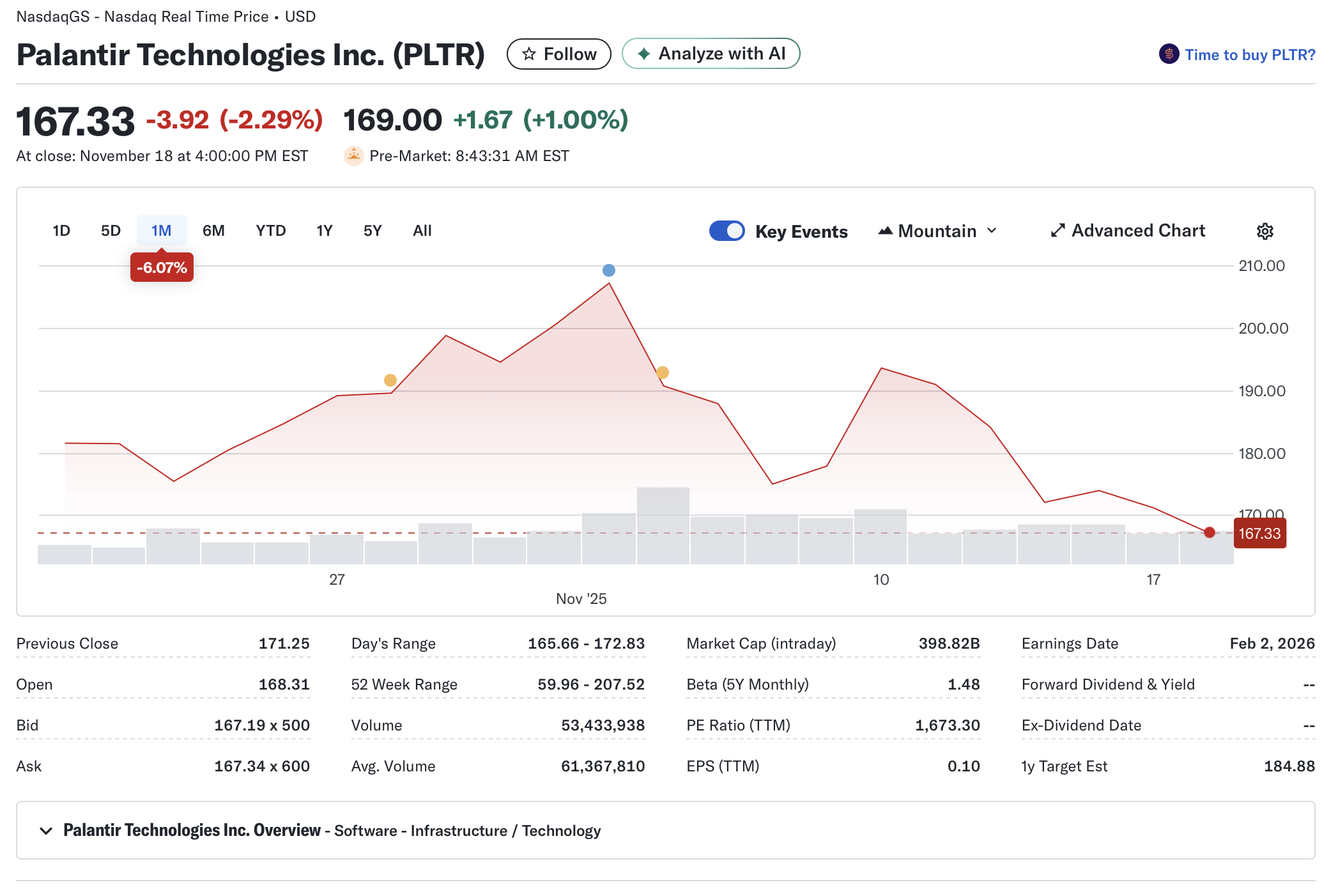

The craziest stock in the bunch is Palantir (PLTR). The 52-week low on this stock was $59.96. The 52-week high was $207.52, which it reached earlier this month. Palantir is an AI play, but the company’s core business is data analytics and their primary customers are governments. Hello, Big Brother!

Check out the below chart for Palantir. No, that P/E is not a typo.

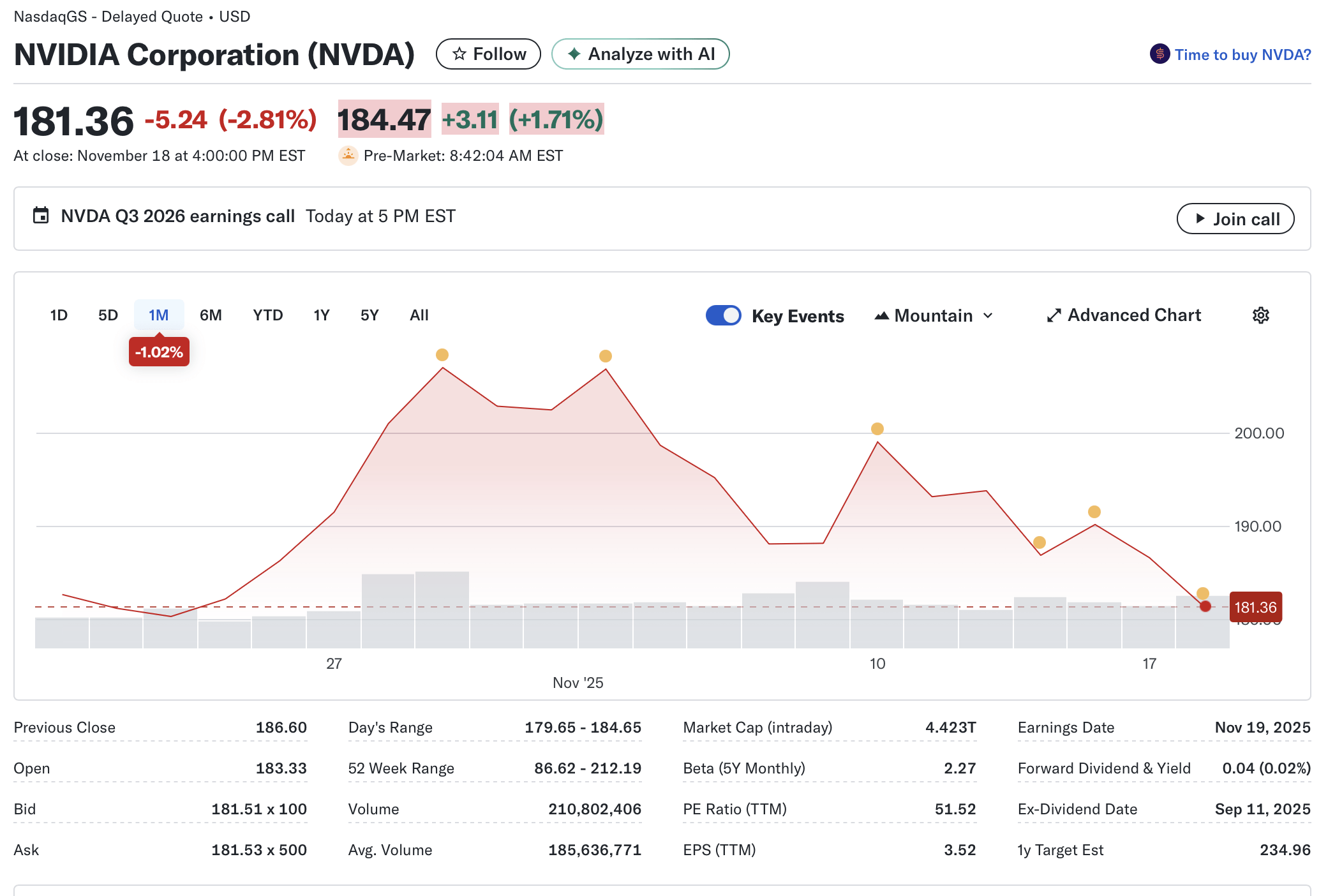

Now look at Nvidia (NVDA). This stock has traded between $86.82 and $212.19 over the last fifty-two weeks. The chart does not reflect the results of its sale revenue released yesterday. The P/E on 51.52, while the average P/E for an S&P 500 stock is 19.53.

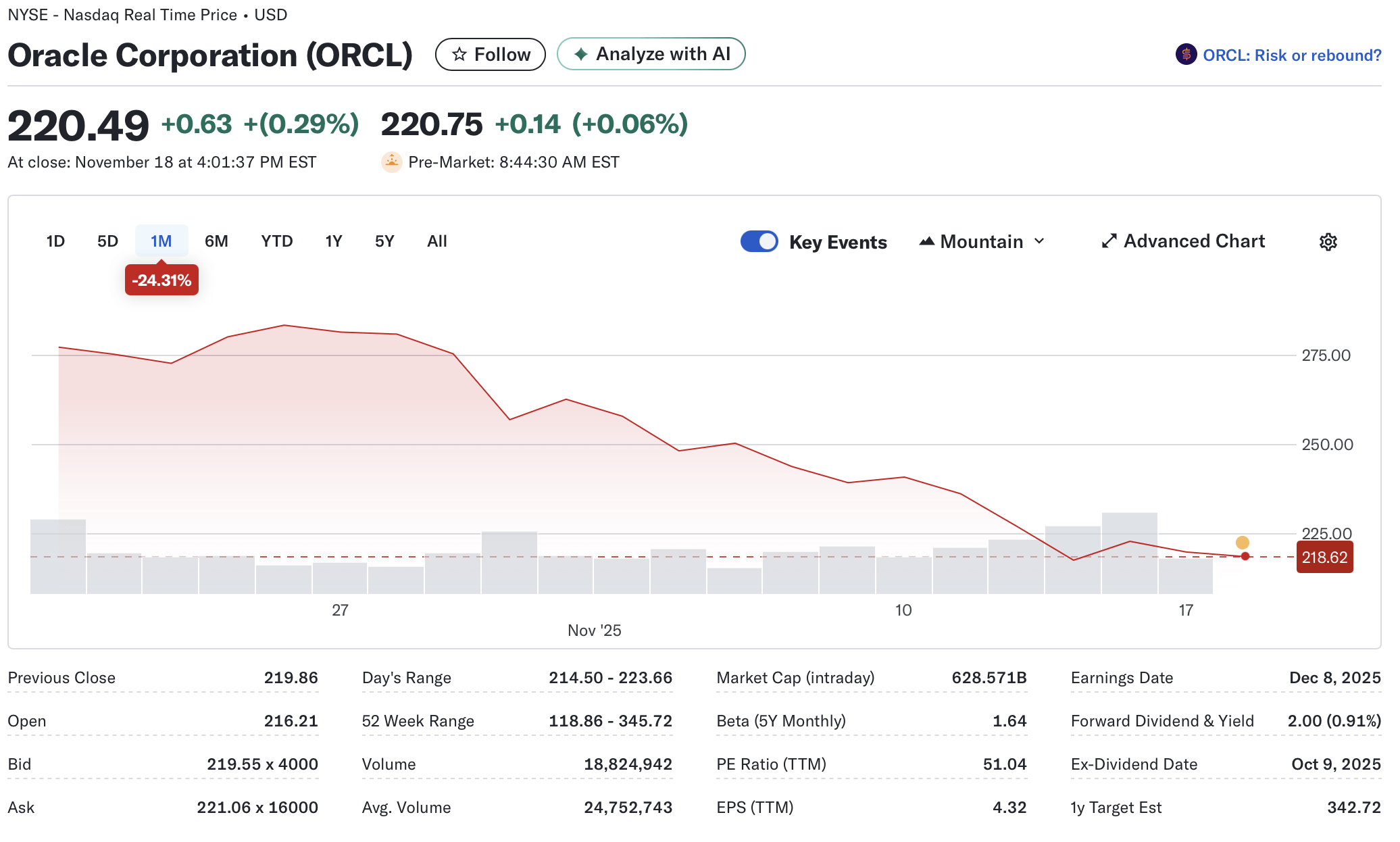

Now we come to Oracle (ORCL). Oracle got its start making relational database software for minicomputers. Boring! It then expanded into enterprise software and acquired Sun Microsystems, which included the open-source MySQL database software and Star Office. (Those two have been forked into free and open-source versions. MySQL’s fork is MariaDB and Star Office’s fork is LibreOffice.)

Now Oracle’s next act is building the data center infrastructure for AI. The company’s 52-week low was $118.86 and 52-week high was $345.72. As you can see, the stock is on its way down, but the P/E is still very high, especially for a mature company like Oracle.

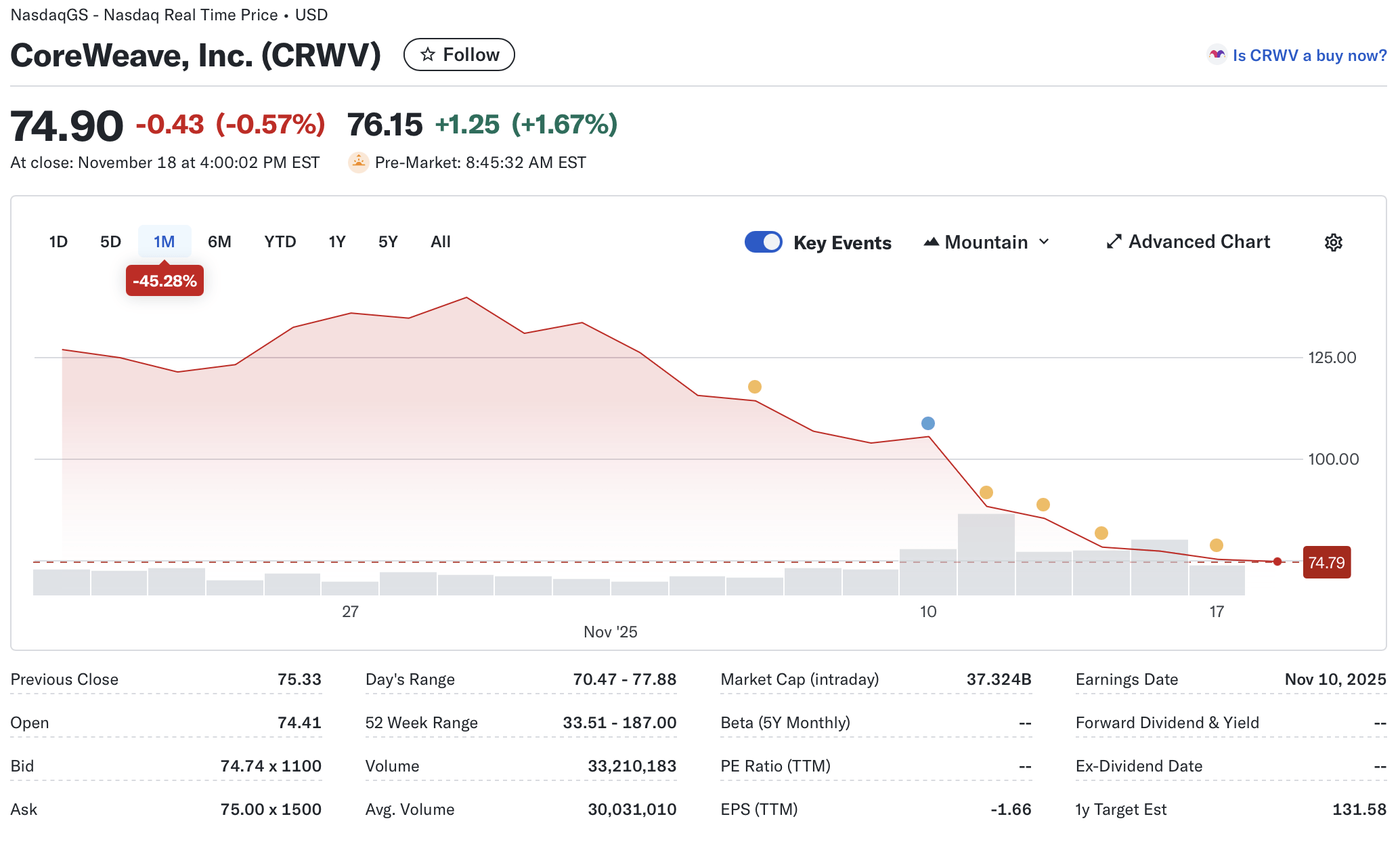

CoreWeave (CRVW) is another stock that can be considered as part of the AI bubble. This company was formed in 2017 as Atlantic Crypto and focused on cryptocurrency mining. (Just the kind of stock you want in your 401(k), right?) When the crypto markets hit a downturn, Atlantic Crypto rebranded itself as CoreWeave and began offering cloud-based GPUs to AI companies.

The 52-week low for this company was $33.51, and the 52-week high was $187. That’s insane! And, it has not made money. It, too, is on its way down.

For those looking try their hand at catching a falling knife, Palantir is your best play. It is widely traded, reducing the risk of a short squeeze, and it is insanely overvalued.

Next would be Nvidia, which has a 52-week range between $86.22 and 212.19, which it reached earlier this month. The company also has a high P/E at 51.92.

CoreWeave has meme stock written all over it and I strongly suggest avoiding it—either short or long.

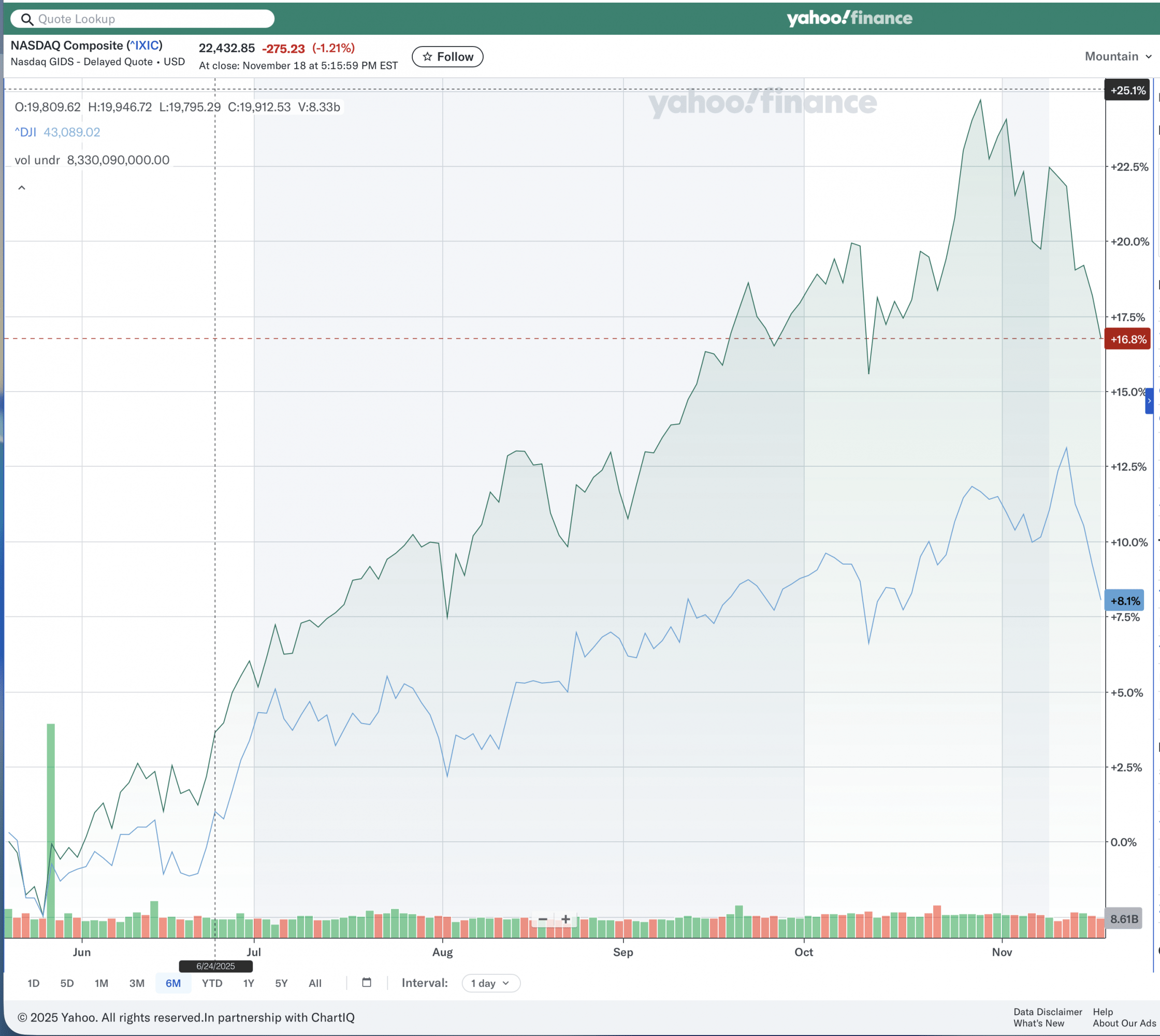

By the way, in case you are wondering, here is a chart comparing the Nasdaq Composite with the Dow Jones Industrial Average. Nasdaq is the green line, and the Dow is the blue one. You get the picture.

What the pros think

I am at the EvolveDigital summit in New York today and tomorrow, and the topic is, as you may have guessed, AI. This conference is attended by technologists and content creators using Drupal and WordPress. The sense is that, while AI holds promise and will change the way we work and produce content, the future is very uncertain at this point. Hence, it would be best to avoid any AI investments now until a clearer picture emerges and these valuations come down to earth.

Leave a Reply